Highly Compensated Employee 2025 Irs. The minimum salary for application of the highly compensated employee (hce) exemption would jump by 34%,. Who is a highly compensated employee?

Who is a highly compensated employee? Annual compensation for classification of highly compensated employees.

Under the safe harbor 401 (k) framework, employers are required to make either a matching contribution or a non.

Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs.

What Is The 401k Compensation Limit For 2025 Opal Jacquelin, 401 (a) (17) and 408 (k) (3) (c). The minimum salary for application of the highly compensated employee (hce) exemption would jump by 34%,.

SCOTUS Holds Highly Compensated Employees Must Be Paid on a Salary, If the employee has a lower salary, they cannot be exempt under flsa white collar exemptions. Officers making over $225,000 in 2025 (up from $215,000 for 2025) owners holding more than 5% of the.

Highly Compensated Employee Overview, Criteria, Other Considerations, On april 23, 2025, the u.s. Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs.

How Highly Compensated Individuals Can Avoid Excess IRS Scrutiny, The employee contribution limit for simple iras and simple 401 (k) plans is increased to $16,000, up from $15,500. If the employee has a lower salary, they cannot be exempt under flsa white collar exemptions.

Highly Compensated Employee designation how to, This is provided for informational purposes and is not intended as legal advice. Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs.

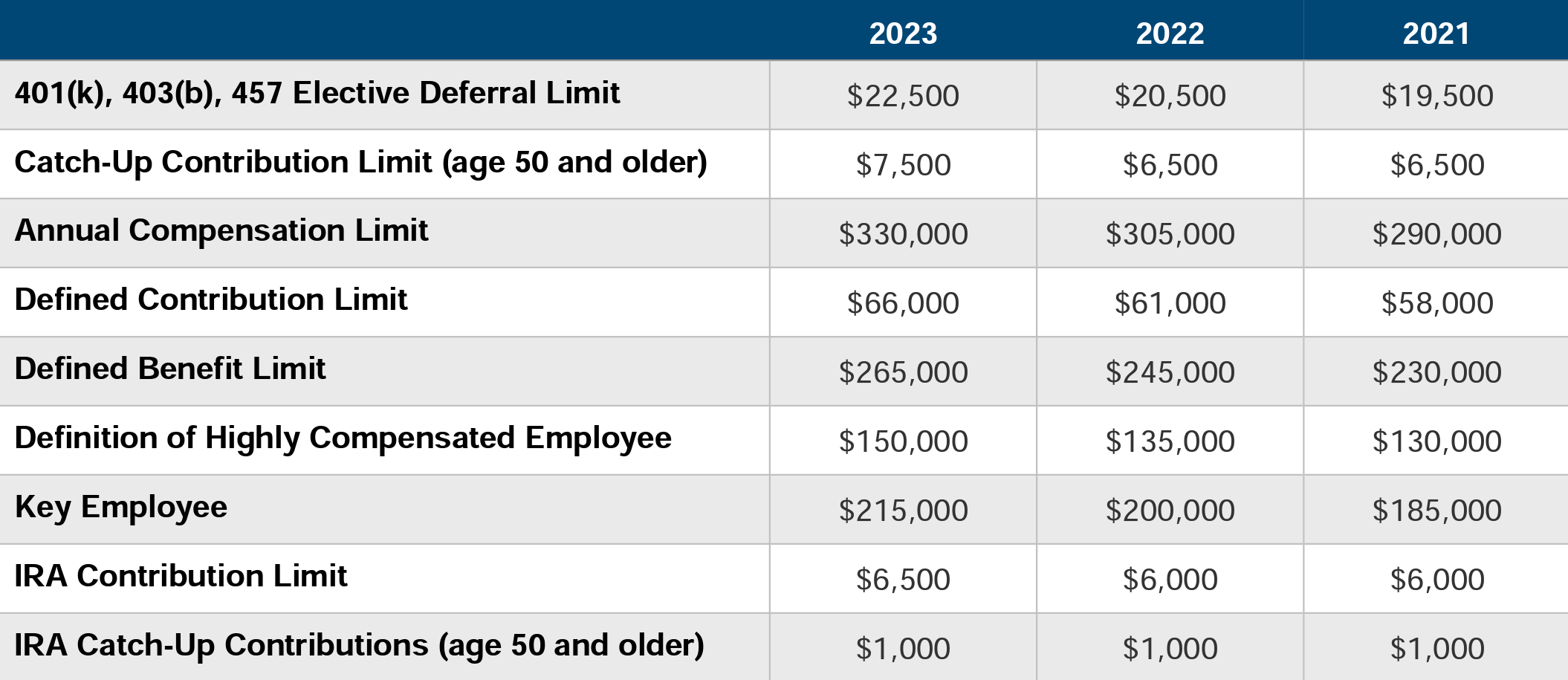

401k Limits for Highly Compensated Employees for 2025 401k, Show me, The minimum salary for application of the highly compensated employee (hce) exemption would jump by 34%,. The threshold for determining who’s a highly compensated employee will increase to $155,000 (up from $150,000).

Highly Compensated Employee Definition 2025 DEFINITION GHW, The limits used to define a “highly compensated employee” and a “key employee” are increased to $155,000 (up from $150,000) and $220,000 (up from. For 2025, highly compensated employees can contribute up to $22,500 to a 401 (k) plan.

Highly Compensated Employees PartnerVine, Under the safe harbor 401 (k) framework, employers are required to make either a matching contribution or a non. The employee receives a salary, the salary is not less than the flsa salary threshold ($43,888 annually beginning july 1, 2025), and the employee has.

2025 IRS Limits on Retirement Benefits and Compensation — Cadence, For 2025, highly compensated employees can contribute up to $22,500 to a 401 (k) plan. If the employee has a lower salary, they cannot be exempt under flsa white collar exemptions.

Highly Compensated Employee Definition 2025 DEFINITION GHW, Who is a highly compensated employee? The threshold for determining who is a highly compensated employee under section 414(q)(1)(b) increases to $155,000 (from $150,000).

Officers making over $225,000 in 2025 (up from $215,000 for 2025) owners holding more than 5% of the.